dupage county sales tax vs cook county

Cook County Illinois Png Images Pngwing. I live in Cook for accessibility to Chicago- expressways and train stations.

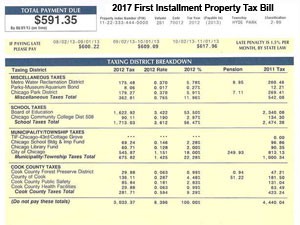

What Is The Right Tax Proration Amount In Chicago Closings Chicago Real Estate Closing Blog

900 St Carlyle IL rate50 cents to a County where the tax Deed Department at 312-603-5356.

. What about your take-home pay. The 2018 United States Supreme Court decision in South Dakota v. This is the total of state and county sales tax rates.

Chicago Home Rule Use Tax. 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425.

24 Champaign County IL. While many counties do levy a countywide sales tax Dupage County does not. The base sales tax rate in DuPage County is 7 7 cents per 100.

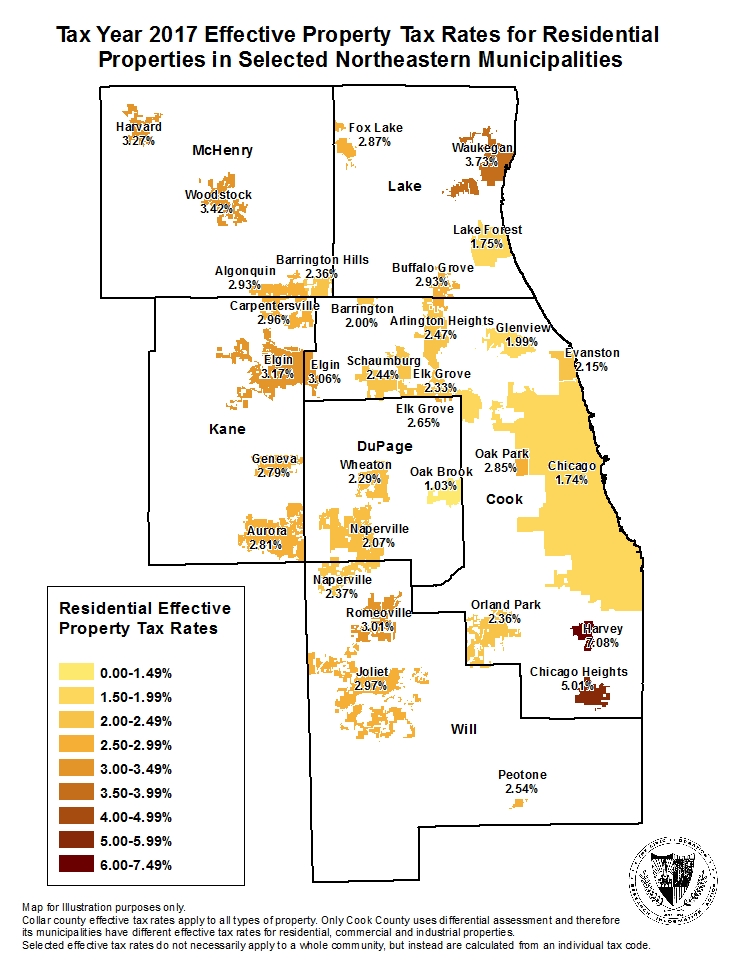

The counties with the Top 25 highest average rates along with their median home values and median annual property tax payments are listed below the map. The satellite coordinates of Bensenville are. At the time the average rate for Cook County including municipal sales tax was about 216 percentage points higher than in DuPage Kane Lake McHenry and Will counties.

Illinois taxes individual income at a rate of 495 and business income at 7. The sales tax in Chicago is 875 percent. Cumberland county 1285 tax assessor.

Cook has more taxes than DuPage. In DuPage County its 675 percent and. Taxes might be slightly less there than in towns to the east but not likely by that much.

Dupage county vs cook countyal arabi sports club qatar. The DuPage County Clerk has a list of 2005 taxes rates by community. The minimum combined 2022 sales tax rate for Dupage County Illinois is.

To include all counties in Illinois purchased dupage county sales tax vs cook county car from a Cook County Dealer will collect more 925. Illinois relies more than Indiana on individual and business income taxes. Lake Zurich being in Lake County wouldnt have the heavy sales-tax burden that Cook County communities have.

Illinois IL state sales tax rate in DuPage are the lowest in the of. Population percent change - April 1 2010 estimates base to. 0610 cents per kilowatt-hour.

Median Annual Property Tax Payment. Latitude 415718N and longitude 875624W. The Dupage County sales tax rate is.

Between Cook County and city taxes you pay 1025 combined sales tax in the city of Chicago. Thanks to the DuPage County sales tax reduction the new rate for services and parts is 75 and the new rate for cars is 7. Look into taxes whether property taxes salestax county tax etc.

The total sales tax rate in any given location can be broken down into state county city and special district rates. In DuPage County property tax rates vary widely between suburbs with 2005 taxes rates ranging from 82058 for Glendale Heights down to 27896 for Oak Brook. These rates were based on a tax hike that dates to 1985.

1337 rows Illinois has state sales tax of 625 and allows local governments to collect a local. 25 DuPage County IL. 15 Boulevard Poissonnière 75002 PARIS.

Tax allocation breakdown of the 7 percent sales tax rate on General Merchandise and titled or. The current total local sales tax rate in dupage county il is 7000. If your main concern is about sales and property taxes Id suggest looking at Kane County and to a lesser extent Kendall County.

Dupage county sales tax vs cook county. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in. The median property tax in DuPage County Illinois is 5417 per year for a home worth the median value of 316900.

DuPage County has one of the highest median property taxes in the United States and is ranked 27th of the 3143 counties in order of median property taxes. There are 902 places city towns hamlets within a radius of 100 kilometers 62 miles from the. I go to DuPage for county free tax gas and liquor.

Heres how Dupage Countys maximum sales tax rate of 105 compares to other. Wishing you the best. The Illinois state sales tax rate is currently.

In Cook County outside of Chicago its 775 percent. The Illinois sales tax of 625 applies countywide. Dupage county sales tax vs cook county.

Dupage County Has No County-Level Sales Tax. The part of Naperville in DuPage County had a 2005 tax rate of 57984. Payments must be received at the local bank prior to close of their business day to avoid a late payment.

Keep in mind that low property tax rates dont mean a county is the best place to invest in nor do high property tax rates mean a county should be out of the running. Compare those numbers to nearby Cook County where youll pay 8 sales tax or Chicago where youll pay 1025. Oak Brook Sales Tax.

DuPage County collects on average 171 of a propertys assessed fair market value as property tax. What is the sales tax in DuPage County. Has impacted many state nexus laws and sales tax collection requirements.

To figure the correct tax due add 125 0125 to. Crawford county 927 tax assessor. Average Effective Property Tax Rate.

Cook county sheriff vs chicago police. The base sales tax rate in DuPage County is 7 7 cents per 100Of this. If you sell an item from a location in Cook DuPage Kane Lake McHenry or Will County and your customers address on Form ST-556 Section 1 is within the corporate limits of the city of Chicago your customer owes an additional 125 home rule use sales tax.

Cook County IL DuPage County IL Population estimates July 1 2019 V2019 5180493. By Annie Hunt Feb 8 2016. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a sellers receipts from sales of tangible personal property for use or consumption.

What Cook County Township Am I In Kensington Research

State Legislature Approves Remap Of Judicial Subcircuits

Illinois Sales Tax Rates By City County 2022

City Property Tax Rates Catching Up With Suburbs

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

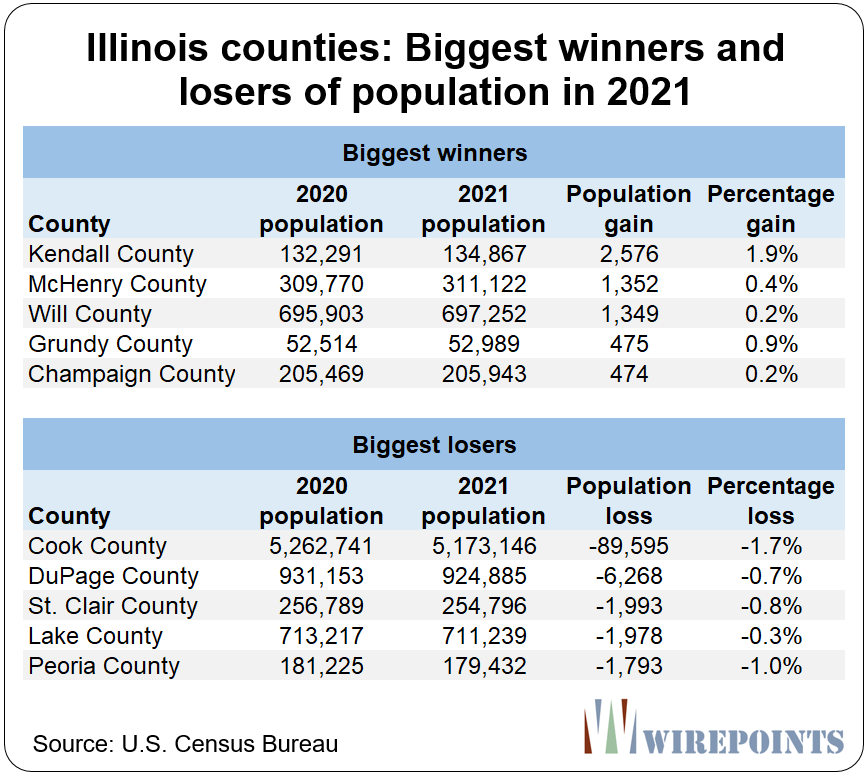

New Census Release 81 Of Illinois 102 Counties Lost Population In 2021 Cook County Lost The 3rd Most Nationwide Wirepoints Wirepoints

Cook County Triennial Property Tax Assessment Schedule Kensington

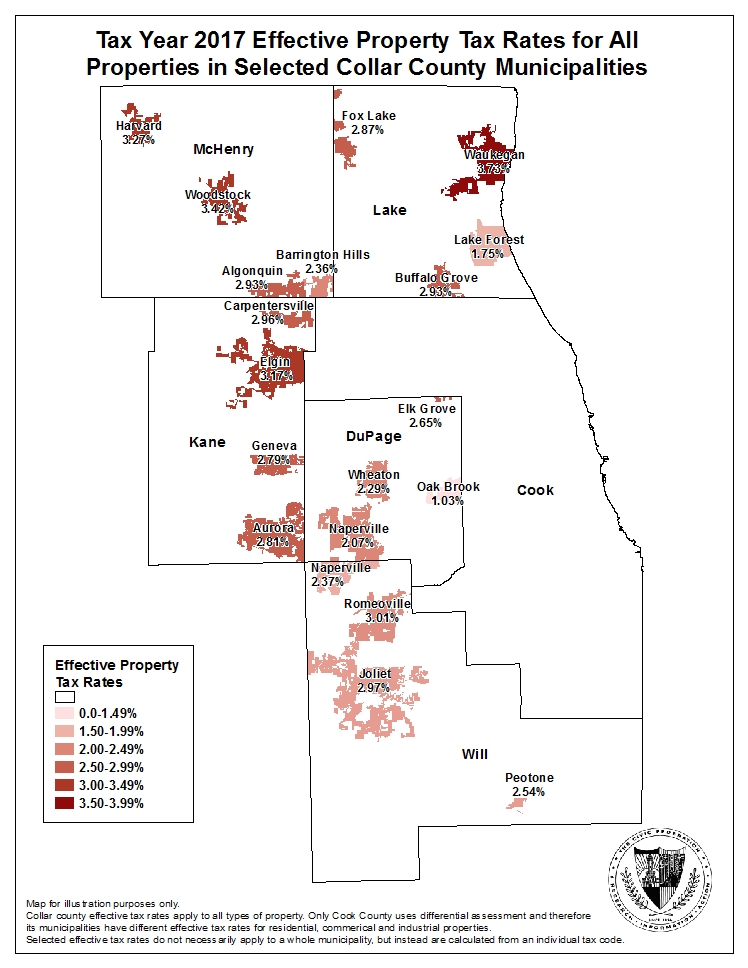

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

How To Determine Your Lake County Township Kensington Research

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Lawsuit Filed In Federal Court Challenging Cook County Property Tax Assessments

Cook County Property Taxes 2017 2nd Installmant Looms Kensington

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Cook County Addresses Unincorporated Pockets Chicago Agent Magazine

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Cities In Cook County Complete List Of Cook County Cities Towns Villages With Population Data Map Information More

Illinois Supreme Court Strikes Down County S Tax On Firearms